5 Ways to Save Real Money

Regardless of the business you are in, your focus likely includes these two areas: 1) how to increase business, and 2) how to reduce costs. And the one key cost that almost everyone is looking to lower is credit card processing fees.

In this article, we will describe five ways you can lower your credit card processing fees. So, if you’re interested in saving a little money (or a lot of money as it often turns out), please keep reading!

Before we dive in, a little background on what goes into your credit card fees will be helpful.

Understanding Credit Card Fees

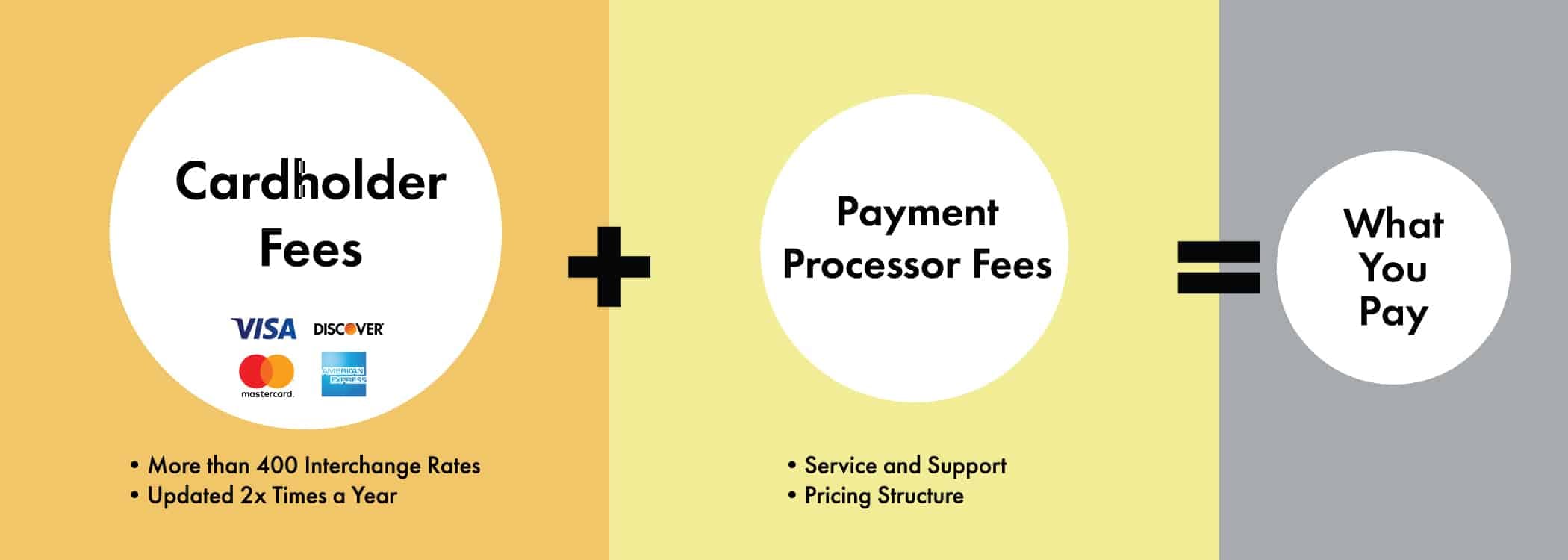

Below is an illustration of how your credit card processing fees are calculated. The largest piece, about 70 percent of what you pay, is interchange charged by the major credit card companies. There are over 400 different fees, and all are non-negotiable. The card brands typically update these fees twice a year – in April and October. (On a side note, Wind River posts the fee changes in our Payments Tips and Trends news brief. For convenience, you can sign up, and we’ll email these updates directly to you.)

Oops! We could not locate your form.

Approximately 30 percent of your statement goes to your payment processor, such as Square, WorldPay, Heartland, etc. Wind River Financial also falls into the payment processor category.

Tip 1 – Qualify for Lower Card Brand Interchange Fees

Even though the card brands do not negotiate their rates, there are things you can do to qualify for lower interchange fees. It often depends on how you’re processing your transactions and what data you pass. Allow me to illustrate.

Card not present transactions such as online purchases or phone sales are riskier than card present transactions (card swiped, dipped, or tapped in person). As a result, card not present transactions are processed at a higher interchange fee than card present transactions.

Ways to minimize those risks and possibly qualify for lower processing fees include:

- Limit manually keyed-in transactions. If you must key in a credit card number, ideally, you’re using an encrypted keypad. If you don’t have one, make sure you follow this process:

1. As you’re entering the card information, never skip over a prompt that comes up on the screen of your point of sale or countertop credit card terminal. The more data you can provide, the lower the risk of fraud, and as a result, the lower the interchange.

2. Enter the CVV code when prompted.

3. If prompted for Order Number, either enter the value or use the last four digits of the card number.

4. Ask customers for their billing address and zip code when prompted. Please note, for the street address or P.O. Box, you only need to enter the numeric portion.

- Use fraud protection tools for online transactions.

- If you accept business credit or purchasing cards, consider passing additional information in the transaction. This will lower your interchange fee. These are called Level 2 or Level 3 transactions.

- Level 2: Business, corporate, or purchase card transactions with sales tax between .1 percent and 22 percent.

- Level 3: Corporate and purchase card transactions with no sales tax requirement

Tip 2 – Detect and Eliminate the “Sneaky” Fees

The sneaky fee trend has really been gaining momentum this year. We call them sneaky fees because they often are cleverly hidden amid the deluge of line items on your processing statement. They typically are unnecessary, and their primary purpose is for your payment partner to pocket more money.

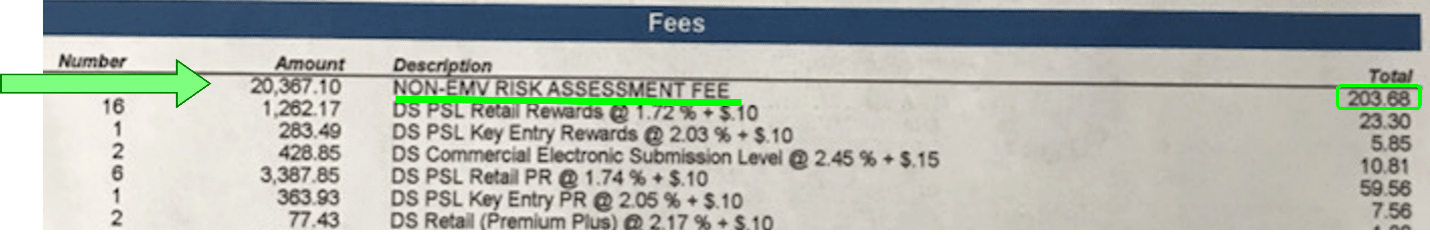

Below is a screen shot from an actual credit card processing statement I recently analyzed.

Two things are noteworthy on this merchant’s statement:

- Non-EMV Risk Assessment fee is a made-up fee by the credit card processor but is displayed as if it is being charged by Visa or Mastercard. Sneaky, right?

- Tucking this fee within the line items of interchange fees ensures that it is easily overlooked by the merchant.

Personally, I find sneaky fees offensive. If you think your credit card processor may be sliding in added fees, I’d be happy to personally analyze your statement to validate whether or not that is happening. No strings attached.

Tip 3 – Get Out of Your Tiered Pricing Plan

It’s pretty common to have a tiered pricing plan. In this type of plan, credit card processing fees may be categorized into specific buckets like the example below.

It seems simple, and a 1.5 percent rate looks nice and low, but in reality, very few credit cards qualify for that lowest rate bucket. Many of the statements I’ve analyzed for merchants show about 75 percent of their transactions are placed in the highest price bucket, without the knowledge of the merchant.

So, if you’re looking to lower your costs, look to get out of a tiered pricing plan.

Tip 4 – Don’t be Afraid to Shop Around

There are two reasons why considering a different processor may be necessary to lowering your processing fees:

- Often when businesses first start accepting credit cards, they sign on with processors offering simple, flat rate pricing. That pricing is designed for lower volume businesses. But as your business matures, your volume increases, and you may be able to find better rates and better service elsewhere.

- Your prices have been creeping up over time. A common misnomer is that if you are in a contract, your rates are locked in. That is definitely not the case.

Big Caution! Rock bottom pricing often means rock bottom service and support. Don’t get lured in on price alone. There is much more to a processing relationship. Trust, accessible and reliable service, security guidance, and pricing transparency are just a few of the attributes of a great payment provider.

Related Topic: What to Look For in a Trustworthy Payment Partner

Tip 5 – Consider Credit Card Surcharging or Cash Discounting

I cautiously include surcharging on my list of ways to lower your processing fees because it can cause serious customer backlash.

Surcharging is a way for businesses to transfer the payment processing costs over to their customers. I’ve yet to meet the customer that likes paying extra just for using a credit card, so I always caution businesses to carefully consider this before implementing it.

Potential ramifications include:

- Reduction in average purchase

- Decrease in customer visits

- Loss of market share to a competitor

If you’re looking to lower your fees, you may want to offer a discount for paying by cash versus a surcharge penalty for paying by credit card. Customers tend to find that a little more amenable.

The bottom line is that your credit card processor should be your advocate and talking to you about all of this. You’re busy running your business so your need to be able to trust that your processor has your back and is helping to lower your costs, not add to them.