Over the course of two years, patients have experienced a 29 percent increase in deductible and out-of-pocket maximum costs. While not overly surprising, it is becoming problematic both for the patient and the provider. From the patient’s perspective, the increase notably outpaces wage growth and can very quickly lead to some serious medical debt.

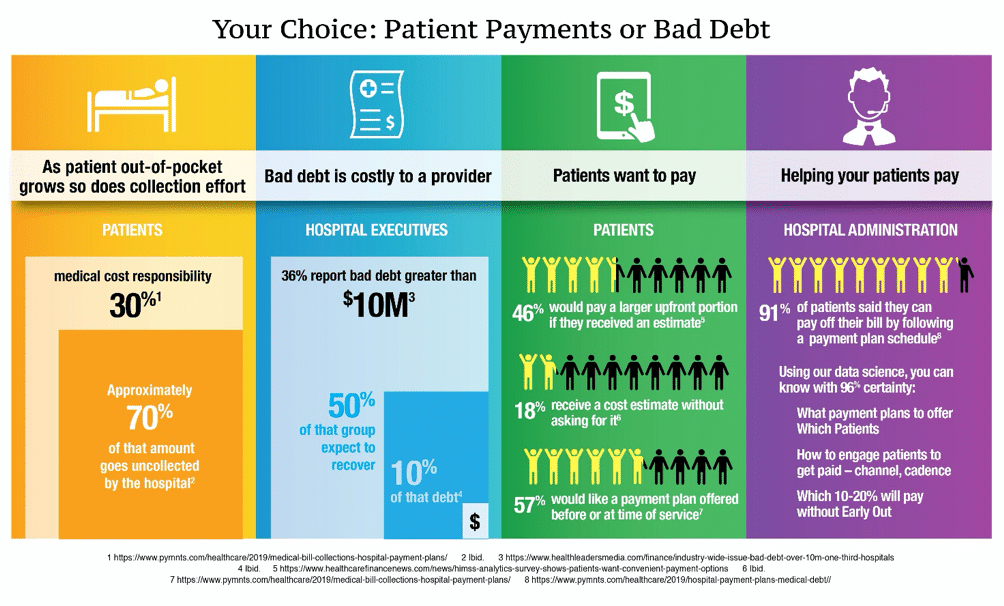

From a provider’s perspective, patients are now responsible for a significantly greater portion of their healthcare bill. Collecting those funds has become a growing effort resulting in about 70 percent of that amount going uncollected.

But the outlook is getting better for both. There are two notable trends that are having a direct impact on patients’ ability to pay and providers’ ability to collect.

TREND 1: Patients Want to Pay Their Bill

As noted in the chart below, patients appear to have a willingness to pay their medical debt, and actually WILL pay it, if providers make it a little more convenient.

These stats are valuable as they highlight two specific payment collection tactics: 1) Providing a cost estimate in advance of service, 2) Offering payment plans to patients who need it.

Cost Estimates

Granted, providing an estimate is not necessarily a simple task as there can be many “unknowns” before service is performed. However, aligning an estimate as closely as possible to the facts you know can go a long way to collecting early funds from millions of patients.

Here’s my back-of-the-napkin calculation:

There were roughly 36,500,000 hospital admissions last year – exclusive of outpatient or medical office procedures. Using the 46 percent research number in the chart above, means that close to 17 million of them would be willing to pay more money in advance if they knew their financial liability.

That number is huge, and my back of the napkin isn’t big enough to calculate the financial impact for providers.

Payment Plans

More than half of Americans do not have a budget for unexpected medical expenses so offering a structured way to pay can be tremendously helpful for both providers and patients. Contributing to the success of payment plans is to proactively offer them at the time the estimate is provided or on the first bill the patient receives. Only about 7% of patients actually prefer to call to request a payment plan.

This also is not quite as simple as it appears. Providers understandably do not want to leave funds on the table. The key is to know, with reasonable certainty, which patients will require a payment plan and which patients will pay in full without one. This is where data science and predictive analytics play an invaluable role.

TREND 2: Greater Emphasis on the Patient Experience

We hear a lot about patient engagement these days. And with good reason. Patients are consumers, and the more cognizant providers are about their interactions with them and the more focused they become on the patient experience, the greater the likelihood of a positive outcome.

Much of patient engagement focuses on promoting overall health management but we see a trend that broadens this to include all patient touch points – from amenities to quality of care to paying for service.

Convenience makes for a better experience. We see this in all walks of life: shopping, traveling, banking, etc. — so why not healthcare? The more convenient it is for patients, the more likely they will pay, and the more likely they will return. The three patient payment features in highest demand, according to Becker’s are:

- Manage their expectations through insurance eligibility verification

- Provide an estimation of cost

- Enable convenient payment mechanisms

Convenient payment mechanisms include healthcare payments made on phones and mobile devices and card-on-file recurring payment options. A gap in the ability to fully deliver these convenient options is that only 20 percent of providers are currently ready for electronic payments beyond checks, cash or credit and debit cards, according to Becker’s.

To gain another perspective on methods to enhance patient payment collection, I turned to Chirag Bhargava, CEO of Chi-Matic, a boutique consulting firm focused on healthcare financial success. He had some definite insight into how providers can leverage patient experience to boost the funds they collect. He agreed to share his best practices so make sure you check out Chirag’s insight into the steps providers can take to immediately impact patient payments.