Payments are complicated – lots of players – confusing terminology, and whole bunch of moving parts. But, understanding the whole process, including the differences between a payment gateway and a payment processor, doesn’t have to be hard. Just think of the entire process as a big railway transportation system.

Let’s start with identifying the people that use the railway and the key stops in the journey along the way.

First of all, there is the Cardholder, the person or business using a credit or debit card. The railway is entrusted with moving money from the cardholder to its destination.

Secondly is the Issuing bank that provided the credit or debit card to the cardholder. The train pulls into the Issuing Bank station to confirm the funds the cardholder wishes to send are indeed available.

Third is the Acquiring Bank. This is the bank that will receive the funds from credit and debit card payments down the track from the Issuing Bank.

And finally, the Merchant (your customer). This is the business entity that receives the money from the Acquiring Bank for the card transaction. The merchant’s bank account is the ultimate destination of funds being transported by the cardholder.

Key Roles in the Railway Transportation

Now let’s move on to the roles that payment gateways and payment processors have in the railway transportation system. There are actually three roles you should be familiar with – particularly if you are a software provider with integrated payments.

- Payment Processor

- Payment Gateway

- Merchant Services Provider (MSP)

Payment Processor

When we think about a train rolling down the track, the payment processor is the rails of the process. Its role is to make sure all the relevant data is correctly routed to ensure cardholder funds arrive at their final destination, the merchant’s bank account.

When we think about a train rolling down the track, the payment processor is the rails of the process. Its role is to make sure all the relevant data is correctly routed to ensure cardholder funds arrive at their final destination, the merchant’s bank account.

Depending on the card brand and the bank associated with the transaction, the processor will “flip the appropriate rail switch” (routing). Flipping the switch makes sure the transaction can proceed down the track that leads to the correct stop.

This ensures everyone has the data they need to approve and process the transaction. The goal is for the funds to make an “on-time arrival” (settlement) at the merchant’s bank account.

Word of caution: The quicker merchants can get their funds, the happier they will be. Some processors work slowly like a steam locomotive when it comes to delivering funds to the merchant’s account. If you are reviewing integrated payment solutions, confirming its on-time arrival rate for delivering funds would be a good question to ask to ensure a good experience for your customers.

Payment Gateway

Think of a payment gateway as a big railway station with lots of different tracks (middleware) attached to payment processors.

Think of a payment gateway as a big railway station with lots of different tracks (middleware) attached to payment processors.

Those different tracks are built, and you can use them to transport your customers’ payments. The caveat being – your customer, the merchant, has to use one of the tracks already connected to the station.

If your customer wants to use a different track (i.e. their own processor), you have a decision to make. You must either build a connection to that track yourself or require your customer use a track already connected to the railway station.

Payment gateways came on the scene when ecommerce was just emerging in the late 90s – essentially becoming the “payment terminal” for the Internet world. Their primary role for online purchases is to securely hand-off the transaction to the payment processor for routing, approval or denial, and settlement.

Expanding Beyond Ecommerce

Payment gateways are no longer just for online transactions. They can provide a seamless experience across all payment channels and multiple payment devices. Some gateways even have integrations with your customers’ accounting systems to simplify reporting and reconciliation. They also provide more efficient ways to review transactions and make any needed adjustments.

There are several benefits of integrating with a payment gateway. A few of these include:

Gateways connect with multiple processors so you don’t have to.

Payment gateways have already built direct connections with various payment processors. This means that if your customers wish to use a particular payment processor, you likely won’t have to code to that processor’s specs – provided your gateway has the connection. This will save you a great deal of time.

Reduced scope for PADSS and PCI Compliance.

Payment gateways can host secure payment page(s) or other connections to your customer’s shopping cart for their ecommerce transactions. When consumers enter the online checkout process, they enter their payment information on a page that sits on the payment gateway’s server. Your customer does not store the information, so it is not on your or your customer’s server. As a result, the scope for PADSS and PCI compliance certification is greatly reduced for you and your customers. This is a good thing for both of you as certification can be complex and consume valuable time and resources.

Payment Gateways Stay Current with Rules Changes from the Card Brands.

Every April and October, the major card brands issue updated guidelines and rules for processing credit card transactions. Payment gateways keep up with the data related coding changes that are needed to interface with various processors and adjust their code accordingly. This saves you a tremendous amount of development work for each potential connection your customers require.

Merchant Services Provider

Lastly, let’s talk about merchant services providers (MSP). A full-service MSP is like the command central for your travel needs on the railway transportation system. The good ones actually become your expert guide, conductor, and an extension of your business. They know the best routes, how to provide the best experience, help you avoid danger, and make your life easier. They’re not just your vendor but rather they are your payments department.

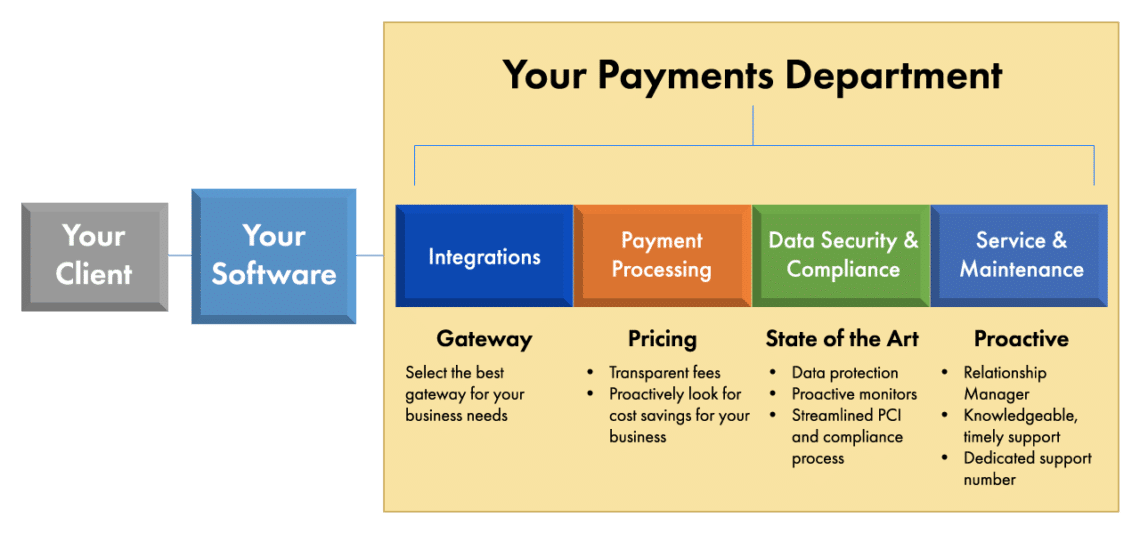

Like most software providers and merchants, your expertise is not in the payments industry. Because of this, you need a knowledgeable and dependable payments department to expertly guide you on key decisions that will enhance the success of your integrated payments program. Below is an illustration of what your payments department will handle for you.

Why you need a merchant services provider

First of all, an MSP will help you determine the capabilities that should be included in your integrated payment program. This includes the technology you and your customers will need and the optimal paths to support those needs.

You could try to select the solution components yourself, but that can lead to unintended consequences. Let’s take gateways for example. Not all gateways have the same capabilities. Suppose your customers need to pass Level 3 data for a lower processing rate? Or, perhaps they want to reduce their PADSS scope? The gateway you choose must accommodate those requirements.

Failing to giving careful consideration to these and other aspects of your program can be costly for you and your customers. Your MSP will help you sort through the gateways to select the best one for your business.

Secondly, an MSP will work closely with your customers on data security and being PCI compliant. This means simplifying the entire process as well as providing ongoing guidance on staying safe and defending against emerging security threats.

Lastly, a full-service MSP can help with the multitude of other aspects of integrated payments, including:

- Transparency of pricing

- Payment related invoicing

- Handling and managing the credit risk of transactions

- Getting your customers boarded quickly and effectively

- Ongoing qualification monitoring to ensure the most cost-effective program

- Fraud monitoring

- Assistance with customer support

You can’t rely on a payment processor or payment gateway to help you with the above tasks because they won’t. As a result, that responsibility will fall to you if you don’t have an MSP. This is why an excellent merchant services provider is so important to your business.

Hopefully this helps clarify the players and roles in the integrated payments process. Feel free to contact me directly if you’re looking for a payment processor, payment gateway or merchant services provider for your integrated payment program.