5 Tips That Will Save You Money

I talk with merchants all the time on a range of different topics. Regardless of where the conversation starts, the subject often moves to how to lower credit card processing costs. Merchants are eyeing credit card processing as a place to save money. Even software companies with integrated payments are interested in cost savings opportunities to pass along to their customers. No one wants to overpay for their credit card processing.

In order to lower your credit card processing costs, the best place to start is to understand the basic components that make up your bill. These elements are Interchange and merchant services.

Interchange is set by the major credit card networks and represents approximately 80% of what you pay. There are hundreds of interchange rates based on a host of different variables. These include type of merchant, credit card being used by the customer, and whether or not the card is present at point of purchase.

These rates are not negotiable. That said, you still may be able to lower your credit card processing costs by qualifying for a reduced interchange rate.

1. Qualify for reduced Level 2 and Level 3 processing rates

There are three credit card transaction levels – each defined by the amount of details that are passed during processing.

- Level 1: Consumer and commercial card transactions – card present and card not present

- Level 2: Business, corporate, or purchase card transactions with sales tax between .1% and 22%

- Level 3: Corporate and purchase card transactions with no sales tax requirement

Essentially, the more information that is passed, the higher the level and the lower the interchange rate.

To the right is a chart that provides the details of what information is required for each processing level.

One caveat. Your credit card technology must have the ability to collect and transmit the data elements required. If you’re not sure what you have, let me know, and I can help you do a quick assessment.

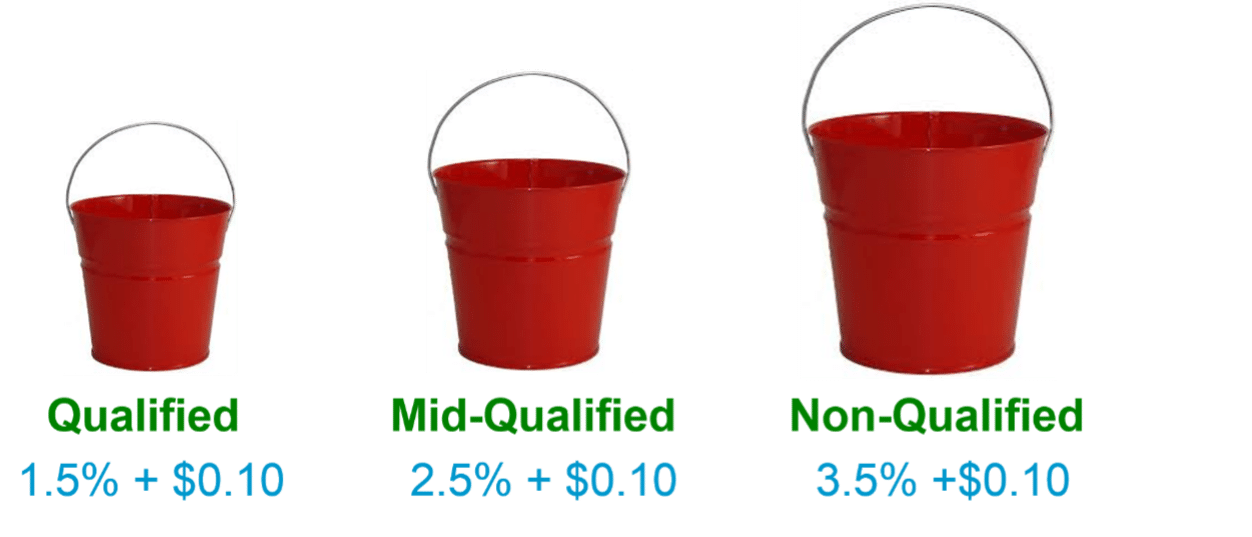

2. Avoid tiered pricing plans

Tiered pricing sounds nice and simple on the surface. But dig a little deeper, and you may discover that while it is easy to understand, it is often nicer to your credit card processor than it is to you. If you want to lower your credit card processing costs, this is a great place to look.

Imagine shopping in a grocery store where everything is one of three prices. Sounds simple, but what if you only want to buy a pack of gum? That purchase may end up costing you $10, which is not a very attractive price.

Think about that in terms of tiered pricing for your payment processing. Let’s say someone makes a purchase with a card that carries a 1.65% interchange rate from the card network.

The lowest tier in the above example is 1.5%. If your payment provider puts it in the lowest tier, they lose money, which is unlikely to happen. So they bump it to the next tier, 2.5%. As a result, you end up paying way more interchange than is necessary. This is good for your payment processor – not so good for you.

Related Video: Tiered pricing explained

3. Get rid of unnecessary fees

Some merchants incur a monthly non-compliance fee as the result of not being PCI compliant. The card networks require PCI compliance for any merchant that stores, processes, or transmits credit card and cardholder data. The reason for this requirement is to add a layer of security to protect against identity theft.

The problem is, PCI compliance certification can be complicated and time consuming. For that reason, some merchants just opt to pay the non-compliance fee rather than deal with the certification process.

This unnecessary fee adds to your credit card processing costs instead of lowering them. However, there are ways to simplify compliance certification or potentially remove your business out of scope. Your payment provider should be talking to you about these options rather than just collect fees from you every month.

4. Collect all the data you can for card-not-present transactions

Card not present transactions have spiked over the past year in lock step with curbside, phone order, and home delivery transactions. These types of purchases carry a greater risk of fraud because no card is displayed at point of sale. Hence, they carry a higher interchange rate.

There’s no way to get around paying that higher rate, but how much higher is entirely up to you. As noted earlier, the more data you provide in processing, the lower your interchange rate. So when accepting card not present purchases, make sure you collect as much data as possible. This will allow you to lower your credit card processing costs for these transactions. Here are a few tips:

- Never skip over a prompt that comes up on the screen of your point of sale or countertop credit card terminal.

- Enter the CVV code when prompted. If it is unavailable, choose “unreadable” as your response.

- If prompted for Order Number, either enter the value or use the last four digits of the card number.

- Ask customers for their billing address and zip code when prompted. Please note, for the street address or P.O. Box, you only need to enter the numeric portion.

5. Consider surcharging

In an effort to lower credit card processing costs, many merchants consider adding a surcharge to credit card purchases. A similar variation offers a discount to customers paying with cash. Both approaches will offset your credit card processing fees, which make them seem attractive.

However, there are many factors to weigh when considering surcharging. There are rules from the card brands that need to be followed. And, some states actually have laws against it.

One of the key considerations is the true cost of cash on your business. There is back office resource time to balance cash drawers and reconcile receipts. But even beyond that, for many merchants, customers paying by credit card tend to spend more – way more. Make sure you quantify the potential impact on your sales before implementing a surcharge.

Related article: The Rise in Surcharging and “Cash Discount” Programs

Talk to Your Credit Card Processor

Lastly, if you’re looking to lower your credit card processing costs, I encourage you to talk to your payment provider. They may have some additional ideas for you.

If you have difficulty getting through to someone to even schedule that conversation, let me know. I can take a look at your statements to see where you may be able to save some money. After all, it can’t hurt and it may result in lowering your credit card processing costs. That makes it well worth your time.