Three Ways Payments Can Help You Sell More Software

How would you complete this sentence? “Integrated payments are . . . “

Some potential answers may be: “Integrated payments are necessary for my customers. Integrated payments are a hassle to support. Integrated payments are a pain in the you-know-what!”

Wouldn’t it be nice if this answer was the first thing that popped into your head? “Integrated payments are a key differentiator from my competitors.” Or perhaps, “integrated payments help me sell more software.”

The reality is many software providers I’ve talked with lately view payments as more of a necessary evil than as a way to gain and retain more customers. As a result, these ISVs are missing out on a tremendous opportunity to leverage payments in a way that is much greater and more lucrative than just another feature in their software.

In this article, we’ll explore ways that ISVs can strategically use payments to fuel their business growth.

1. Use Your Payments to Solve Problems

Payments are near and dear to the heart of any business owner. Solve a problem they’re having with payment acceptance, and you’re a hero.

Here’s a great example. A Midwest-based software provider had a great new business opportunity with a retailer. All the pieces were falling into place, except for one. And that one was related to payments.

This ISV’s integrated payment capability had not kept up with the rapidly evolving needs and preferences of customers and consumers. If they wanted to close the business, they needed to modernize their program in four short weeks.

You can read the full story here. Spoiler alert: the payment partner (okay, it happened to be Wind River) came through with the necessary enhancements well within the given timeline. All worked well, and the ISV landed a six-figure software deal. In addition, the modernization has helped this ISV land multiple new clients that it otherwise would not have gotten.

2. Use Your Payments to Accelerate Software Enhancements

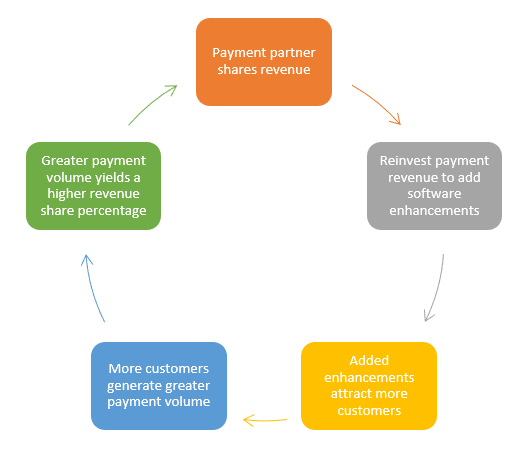

Integrating payments in your platform can have a much greater role in your success than simply enabling customers to process payments through your platform. It can be the catalyst that accelerates your development and enhancement cycle. It looks something like this:

The more payment integrations in your software, the less likely you are to generate payment volume at a level that would qualify you for a higher percentage of revenue. Typically, the greater the payment volume, the greater the revenue share percentage. This can lead to some significant cash flow you can use to reinvest in your software – or whatever else you choose. However, by spreading your customers’ payments across multiple providers, you won’t be able to muster enough volume to climb out of the lowest tier.

On the flip side, by consolidating payment activity to one or two preferred payment partners, you can leverage the aggregate volume to get to the highest tier.

3. Use Payments to Fully Control Your Customers’ Experience and Your Revenue

For software providers that have had integrated payments for a while, you may be considering graduating to the next level, white label.

A white label payment program allows you to use the technology of your payment partner under your brand name. In the eyes of your customers, it is your program, you own it. They typically don’t see the name of your payment partner – only yours. You provide the first level of customer support. And you also control the pricing your customers pay to process payments.

While knowledge of payments is a huge bonus for any ISV wishing to upgrade to a white label program, it’s not always necessary. A good payment partner will have a training wheels period where they help you get up, running, and comfortable supporting your customers’ payment experience.

A key benefit of a white label program is that you can indeed control your customers’ experience. If you’re supporting multiple payment integrations, quality customer service can vary wildly from payment provider to payment provider. In a white label environment, your customers call you with their payment questions and issues – just like they do with software questions and issues.

A great example is software provider, SRS Pharmacy Systems. They that wanted to extend their customer promise of One System, One Vendor, One Call to include the payment experience. So, they embarked on a path of implementing a white label payment solution in their platform. You can read the story of their white label payments journey here. It’s interesting and full of valuable insight.

A second key benefit is revenue. You can charge your customers whatever you’d like for payment processing. Certainly, there are many considerations with pricing, and your payment partner should work with you to understand market conditions and other factors that come into play. The bottom line though, you can earn significantly more revenue with a white label program. And, as noted in the second point above, you can do a lot of things with that added income to drive business growth.

What You Need from Your Payment Partner

To truly harness the potential power of integrated payments, you’ll need a preferred partner rather than multiple payment partners. It’s simpler to support the environment, and depending on which partner you choose, your entire program can be elevated. Here’s what to look for:

- Payment partner that is a nimble, creative problem-solver. If you have an opportunity to close a software sale but need an enhancement to your payments, a nimble payment partner will come in handy. The last thing you need is to waste time even trying to get a call back from a provider that is too busy to talk to you.

- Payment partner that keeps you ahead of trends and tech advancements. Remember the example of the midwestern software provider I mentioned above? If this ISV’s payment provider had helped them keep their payment capability current with the times, they may not have had to scramble so much to enhance their solution.

- Payment partner that tiers its revenue share. Surprisingly, not all integrated payment providers offer to share their revenue with their software partners. This is a missed opportunity to generate an income to reinvest in growing the business.

- Payment partner that will guide you through whichever stage of payments you are in. This means if you desire to implement a white label program, your payment partner will provide everything you need as well as train you on how to manage your new payment program. If you simply wish to maintain your payment capability, your partner will help make that easy for you.

- Payment partner that treats your customers the way you treat them. This is important for all integrated payment programs. Too often the quality of customer service and support is lacking – particularly if you have a mega-payment provider, that may focus only on larger customers.

Related Article: The Strategy Behind Choosing an Integrated Payments Partner